Federal employees considering retirement are constantly debating whether or not they should work for another year, or two years, or even three. This is a great question and brings up a whole slew of criteria that need to be evaluated before reaching a conclusion.

The first thing that more time will do is increase your FERS annuity.

Each year of service adds an additional percent to your high-3. A federal employee’s high-3 is what their retirement income is based on. The high-3 is a federal employee’s highest average basic pay earned during any three consecutive years of service. For most employees this will be their last three years of service.

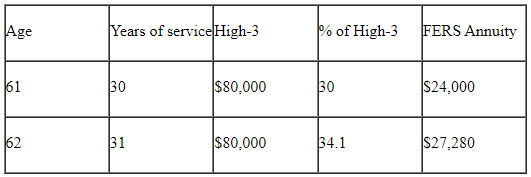

Each year of service gives regular FERS employees one percent of their high-3 as retirement income. For example, the FERS annuity for an employee with 30 years of service will be 30% of their high-3. If a person with a high-3 of $80,000 delays retirement by a year, they will increase their FERS annuity by $800 a year.

Federal employees that are age 62 with over 20 years of service will get more.

An exception to the 1% rule is if the employee is age 62 or older and retires with 20 years of more of service. Employees in this scenario will use 1.1% as the multiplier of their high-3.

This can prove to be very beneficial for employees that are contemplating retirement and are near age 62. Using the example above we can look at the difference it makes for an employee retiring at age 61 with 30 years of service to wait for one year and retire at age 62.

An employee working one more year in this scenario would increase their FERS annuity by $3,280, which is significantly better than the former example we looked at which increased by $800.

There is an obvious benefit of working another year or two if you are close to the age of 62 and have 20 years or more of service. That extra year could make a big difference in your annual retirement income.

Step increases can help retirement income.

If you are due to get a step increase in the near future, that could increase your high-3 as well. Any increase in pay (basic plus locality or market pay) will directly impact your FERS annuity. The longer you work with that higher pay, the higher your high-3 will be.

It is important to understand that bonuses, overtime, and shift differential are not factored in to your high-3.

Your Social Security could be higher.

Social Security benefits are based on a person’s highest 35 years of earnings. If you add another year of higher earnings to your work record, you will have a lower year drop off and a year with higher earnings will be added. This benefit isn’t likely to be a big difference but can definitely increase your Social Security.

More time provides additional time to save.

This is often the biggest benefit to working longer. Many federal employees I speak with will retire with an income that is lower than their current income. Working an additional year or two provides additional funds for savings as well as additional TSP matching.

The employee making $80,000 that is contributing 5% to TSP will also receive a government contribution of 5% which equals $4,000. An employee that could save the maximum in TSP could defer $22,500 on top of the government match.

Additional savings could be used to pay off debt, increase an emergency fund, or even pad retirement savings.

Additional growth on your money.

One often overlooked benefit of delaying retirement is growth on your investments. For example, if an employee has $500,000 saved and earns 8% in a year, that would account for an additional $40,000 of retirement savings. Delaying retirement by two or three years could provide quite a bit of additional benefit.

Should you work longer?

These are a few ways that federal employees can benefit by delaying retirement for a year or two. Retirement dates are one very important issue that we help our federal clients with. If you are looking for a CFP® professional to help with questions like these you are welcome to schedule an introductory call with Brad.

Brad Bobb, CFP® is the owner of Bobb Financial Inc, and an expert in retirement planning for federal employees.