A client recently asked a common question: “Should I pull money from my Thrift Savings Plan (or IRA) to pay off my mortgage?” In this case, the retiree had seven months of payments left in 2026. His goal? Eliminate the debt for peace of mind.

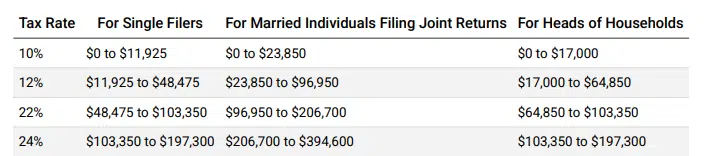

While paying off a mortgage feels great, we need to weigh the costs. Withdrawing from a TSP is a taxable event—100% of the distribution counts as taxable income. This client, in the 12% federal tax bracket (and likely to stay there throughout retirement), needed $13,000 to pay his mortgage off. Here are the federal income tax brackets.

Here’s what his distribution and tax hit would look like:

- Withdrawing $4,000 nets $3,520 after 12% federal tax.

- Withdrawing $12,154 nets $9,480 after 22% federal tax (since $9,000 pushes him into the 22% bracket).

The total withdrawal needed was $16,154 to net $13,000 but keep in mind that is just federal tax. Many states have a state income tax which only increases the withdrawal that would be needed.

If he could withdraw all of the funds and stay in the 12% federal tax bracket then paying the mortgage off might make sense in his case, but he can’t. Only $4,000 would be taxed at 12% while the remainder would be taxed at 22%.

Another factor is the mortgage interest rate versus TSP investment growth. A higher return on his investment makes it harder justify taking funds out of the investment to pay off a low rate mortgage. Here, it wasn’t significant because:

- Most of his remaining payments went toward principal.

- The short seven-month timeline limits investment growth.

With growth not a major factor, the decision hinged on taxes. The extra tax burden made withdrawing funds less appealing.

What about withdrawing funds from a Roth IRA to pay the mortgage off because qualified Roth distributions are income tax free? It didn’t apply in this situation but is a good question to consider. Withdrawals from a Roth IRA can be appealing for the tax free reason, but, would you really want to withdraw funds from a place where they will grow income tax free for the rest of your life? I certainly wouldn’t want to do it to pay a mortgage off and I don’t think it would be a wise financial decision.

Takeaway

Withdrawing from a TSP or IRA to pay off debt isn’t straightforward. Higher withdrawals often mean higher taxes, which can outweigh the benefits. While paying off a mortgage early can make sense in some cases, it didn’t here. At Bobb Financial, we help clients navigate these choices. Schedule a call if you’re looking for a CFP® professional to help you throughout your retirement journey.