This is a headline that I see often on retirement articles, but is it possible?

Yes, it is possible, but the more realistic headline would be: “How to Retire and Maintain a Low Income Tax Bracket.”

Before we dive into details, I want to point out that when you see this title, it is normally “click bait” to try and sell you a type of life insurance product.

How can you achieve a tax-free retirement?

A few things would need to occur for this perfect scenario to pan out:

- You only have a small FERS annuity or other kind of pension that is taxable.

- Your Social Security is small, or delayed, until as late as possible.

- You have a substantial amount of funds in a taxable account.

- You have a substantial amount of funds in a Roth IRA (or tax-free account).

Keep in mind we are only talking about federal income tax in this article as state income tax policies vary widely.

It is feasible for someone to leave federal service early and do a deferred or postponed retirement and pay little to no income taxes. Here is an example of what that could look like:

Early Joe retires with 18 years of FERS service. Joe, who is single, was a FIRE (Financial Independence Retire Early) guy and did a great job of saving. At the age of 50 he had the following assets:

- Roth IRA – $500,000

- Taxable brokerage account – $650,000

- Bank account – $25,000

Joe doesn’t have any debt and plans to live off his investment income until he qualifies for a FERS annuity and Social Security. Distributions of principal from his Roth IRA are penalty free and not taxable. His brokerage account is invested in passive ETFs that hold stocks. He is a “buy and hold” investor; therefore all his distributions are classified as long-term capital gains (LTCG). Joe’s taxable income will keep him in the 12% tax bracket, which means he will pay 0% on LTCG.

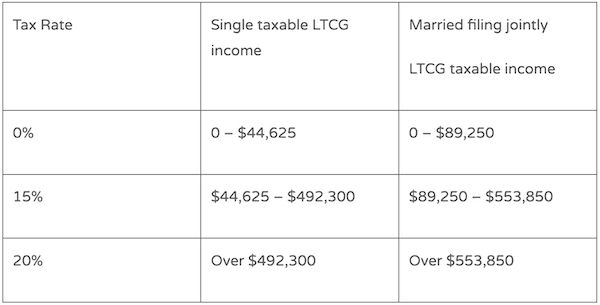

The table below shows how LTCG are taxed:

Taxable income is your Adjusted Gross Income (AGI) minus the standard deduction unless you itemize your taxes. The standard deduction for single persons is $13,850.

If Joe sells shares in his brokerage account, and has held them for more than 12 months, the proceeds will be taxed as LTCG. Looking at the table above, Joe can sell shares with gains up to a limit of $58,475 ($44,625 + standard deduction of $13,850) while staying in the 0% capital gains bracket. In this scenario Joe wouldn’t pay any income tax.

Joe could also have a small FERS annuity or Social Security under the exemption amount of $13,850 and still pay no federal income tax – as long as he stays under the taxable LTCG income limit of $44,625.

The above is a possible scenario for a federal employee, but not a probable one. A more likely scenario would be having the ability to” engineer” your tax rate in retirement.

The engineering approach can be used if you have investments in different types of accounts such as a TSP, IRA, Roth IRA and brokerage account. Engineering your tax bracket refers to taking funds from different accounts that are all taxed differently, therefore giving a retiree tax bracket flexibility.

The concept of engineering your own tax rate is something that is possible, and I would recommend everyone look into. A tax free retirement is very unlikely for most federal retirees. You are welcome to schedule an introductory call if you would like help reducing your taxes in retirement.

Brad Bobb, CFP® is the owner of Bobb Financial Inc, and an expert in retirement planning for federal employees.