“The Thrift Savings Plan is cheap” may be the most common statement I hear to describe TSP, typically from people nearing retirement who are considering options outside of TSP. But is the TSP really “cheap”?

There are many factors to evaluate when deciding whether or not to leave money in TSP. Cost is definitely one of them, but it’s not everything. Here is a video that covers the other criteria that should be evaluated, but for this article we are going to focus on costs.

When people refer to expenses in the TSP, they’re typically referring to the fund expense ratios. The funds in TSP are index funds which tend to have some of the lowest expense ratios.

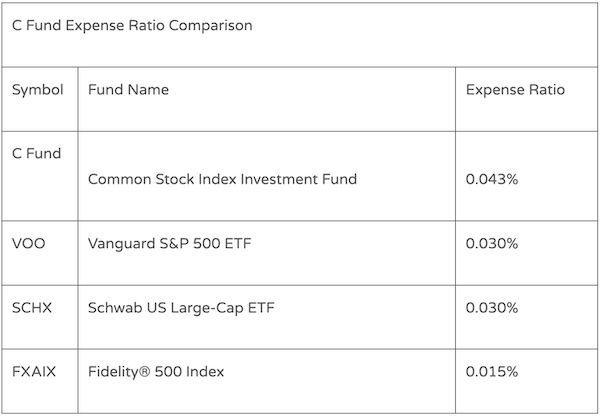

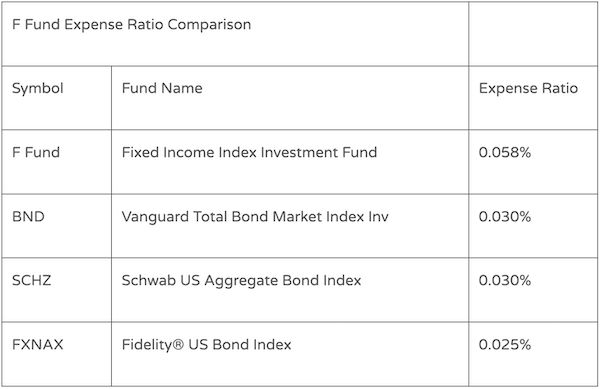

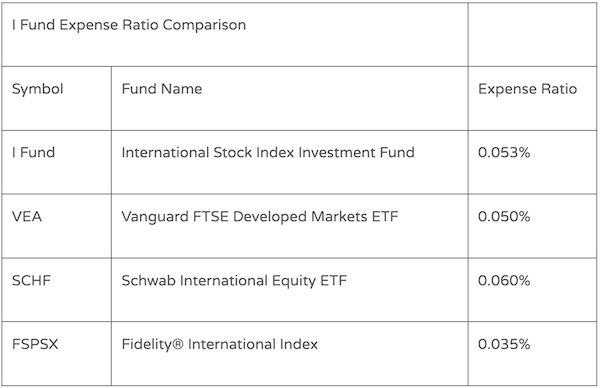

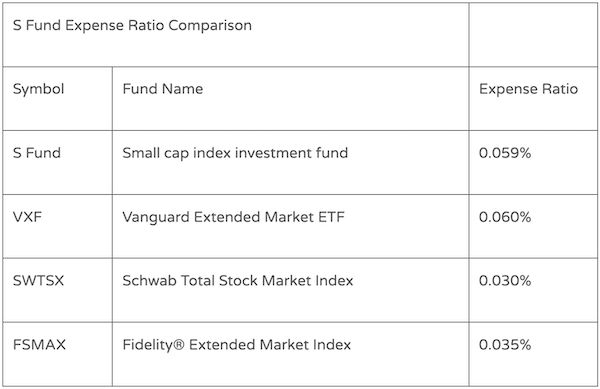

By most metrics, TSP expense ratios are low but that doesn’t mean they’re the lowest available. I decided to do a comparison of TSP fund ratios against three major custodians – Schwab, Fidelity, and Vanguard. (Keep in mind that expense ratios can always change, and you can go to each custodian’s website to get the most up to date information.)

Here’s what I found:

A review of the C fund shows that TSP has the most expensive expense ratio of the four.

The F fund nearly doubles the expense ratios of the equivalent fund from the other three custodians.

The I fund is competitive but not the cheapest.

TSP’s S fund has high expenses compared to the Schwab and Fidelity equivalent, but nearly equal to the Vanguard equivalent.

Notice I didn’t do a G fund comparison. This is because the G fund is unique. It is designed to provide interest equal to the 10-year Treasury rate, but it is unique in the fact that it never loses value. This combination makes it difficult to compare to an equivalent.

Custodians can have other expenses as well. Two common ones are trading fees and custodial fees. TSP doesn’t have fees for either of these. From what I can find on the other three custodians’ websites, they don’t appear to have a custodial fee either. Each of the three custodians offer free trading for stocks and ETF’s but may charge a transaction fee for certain mutual funds. If you buy your custodian’s mutual funds, such as buying a Vanguard fund at Vanguard, they typically don’t charge a fee for buying those.

What are we to make of all of this information?

- The TSP does not have the lowest expense ratios.

- However, the TSP is generally competitive with other custodians.

- You may decide that keeping money in TSP is the best thing for you and your situation, but expense ratios should not be the primary reason.

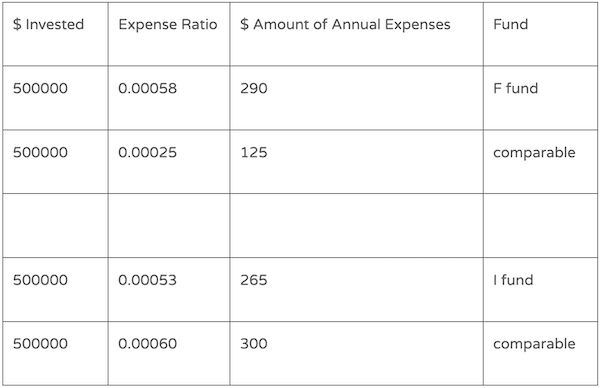

To fully understand the impact expense ratios will have on your investments, let’s look at an actual dollar amount. If we look at an example of $500,000 invested in the F fund (versus a competitor with the lowest expense ratio) and the I fund (versus a competitor with the highest expense ratio), the expenses would be the following:

As you can see above, the differences are minimal in the actual dollar amount on a $500,000 investment. But if you want to compare the average weighted cost for a diversified portfolio in TSP to another custodian, the outside custodian will likely be cheaper.

Do not make a decision to keep or leave TSP based solely on cost, but rather take your time and evaluate costs along with other factors as seen in this video, and this video, and then make your decision after doing some due diligence. These are the exact things we help our clients with so if you would like to schedule a call with me, click this link.

Brad Bobb, CFP® is the owner of Bobb Financial Inc, and an expert in retirement planning for federal employees.