Federal income taxes can be terribly misunderstood. Sometimes I believe that whoever writes tax law wants us to misunderstand it. Ronald Reagan once said, “It takes a smarter person to pay taxes on our income that it does to actually make the income!” His assessment was pretty spot on.

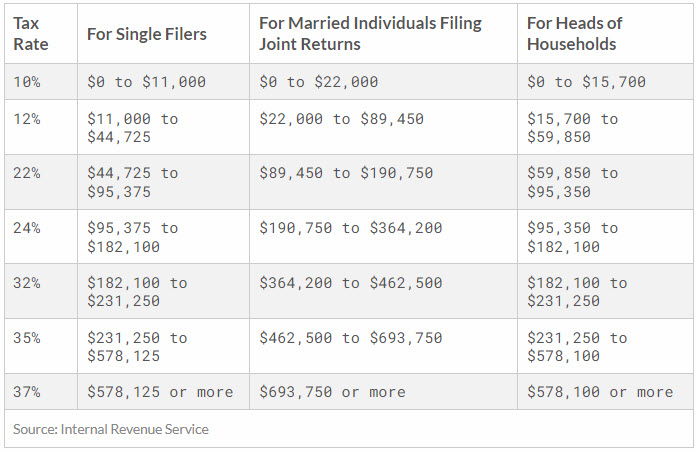

We have a graduated income tax system in the United States. This means that households with higher incomes pay higher taxes, but it doesn’t mean they pay higher taxes on all of their income. The chart below shows how our graduated tax system works.

With this framework in place, I hear many disgruntled individuals say, “It doesn’t pay for me to work anymore” when it comes to working overtime to earn extra income. They believe if they make $50 an hour working overtime then the government will take the majority of their earnings because they get pushed into a higher tax bracket.

This simply isn’t true.

Here is a chart showing federal income tax rates for Single filers and Married filing jointly.

Please understand that an individual making $100,000 does not pay 24% income tax on the full amount, but rather 24% on the amount over $95,375, and 22% income tax on the amount from $44,725 to $95,375, as well as the respective 10% and 12% brackets. Hence, the term “graduated.”

THIS is how federal income tax brackets work. There is no such thing as, “I reached a higher tax bracket where it doesn’t pay me to work!” That bracket doesn’t exist!

Why it’s important to understand how tax brackets work.

Most federal employees are going to retire with a FERS Annuity and will begin collecting Social Security at some point. Any income on top of those two sources typically comes from investment accounts. Pulling income from investments can give you more control over your taxable income and having multiple accounts with different tax treatments can provide you with flexibility.

- Tax deferred accounts such as TSP and IRAs will be 100% taxable when funds are withdrawn.

- A Roth IRA or Roth TSP does not count as taxable income when withdrawals are taken.

- An individual, or brokerage account is typically taxed when shares are sold.

Holding a combination of these three accounts gives you more control. If your income in a given year is on the edge of going into a higher tax bracket, you can choose to pull funds from an individual account or Roth IRA in order to keep your taxable income lower.

In years that taxable income is low, you might choose to do a Roth conversion to “fill up” a low tax bracket. For example, if a married couple has 60k of income they may choose to do a Roth conversion of 20k to “fill up” the rest of the 12% tax bracket for that year. If they end up with income slightly into the 22% tax bracket, they would only pay 22% income taxes on the portion above the 12% threshold.

Tax brackets can be misleading but are very important to understand. Having a knowledge of how our income tax system works can help you to navigate the tax codes and save valuable tax dollars. If you are near retirement and would like a partner to help with tax matters, you are welcome to schedule an introductory call with me.

Brad Bobb, CFP® is the owner of Bobb Financial Inc, and an expert in retirement planning for federal employees.